The Political Transition: From President Donald Trump to President Biden

The transition from President Donald Trump to President Biden marked a pivotal moment in American politics, a period of change and anticipation that ‘What Am Politics?’ captures with acute awareness. The podcast delves into the dynamics of this political shift, examining the immediate and long-term impacts on the fabric of the nation and the globe. Through engaging talk and analysis, the co-hosts chart the course of this significant historical event, discussing everything from the peaceful transfer of power to the controversies that surrounded the White House during this time. This series of episodes provides listeners with a clear, coherent narrative of the transition, highlighting the importance of democracy and the resilience of civil society in facing the challenges of change.

Analyzing the Policies of Former President Donald Trump

Diving into the era of former President Donald Trump, ‘What Am Politics?’ offers a comprehensive analysis that goes beyond the headlines. The co-hosts meticulously dissect the policies and decisions that defined Trump’s tenure, from his notable appointments to the Supreme Court to his controversial handling of classified documents. Each episode aims to unpack the ramifications of Trump’s politics on both the United States and the world at large, fostering a conversation that’s as informative as it is interesting. This exploration provides rich material for analysis, which could be further developed into a compelling philosophical discourse. A philosophy essay writer at DoMyEssay could take these discussions and craft an essay that delves deeper into the ethical, social, and political theories underlying these political movements, providing a nuanced perspective that enriches the conversation even further. The podcast doesn’t shy away from tough topics, instead, it invites listeners to examine the layers and complexities of government actions under Trump’s administration, making sense of the political landscape with an approach that’s equal parts critical and accessible.

Understanding the Agenda of President Joe Biden

As the political baton passed to President Joe Biden, ‘What Am Politics?’ shifted its focus to the new administration’s ambitions and challenges. The podcast explores Biden’s agenda with an eye for detail, analyzing how his policies aim to reshape the fabric of American society. From tackling the pandemic to addressing climate change, the co-hosts break down Biden’s priorities and the implications for both domestic and international politics. This segment of the podcast serves as a vital resource for listeners looking to grasp the nuances of President Biden’s approach to governance, offering insights into his vision for the future. Through lively discussion and expert commentary, the episodes create a space for understanding and talking about the hopes tied to Biden’s presidency.

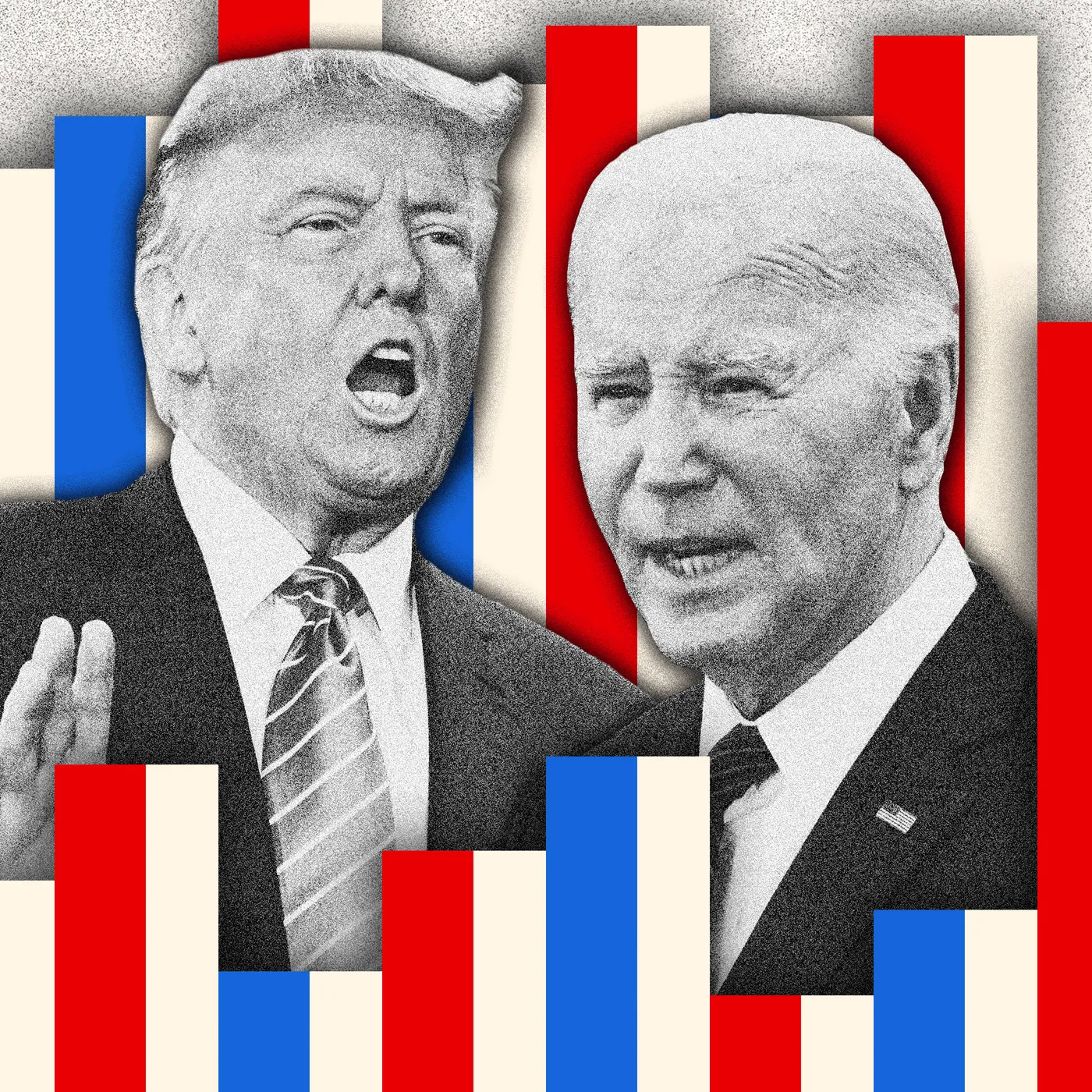

Key Issues in Focus: Biden vs. Trump’s Approaches

In a bid to offer listeners a deeper understanding of the contrasting styles and policies of President Donald Trump and President Joe Biden, ‘What Am Politics?’ dedicates episodes to dissecting key issues. From environmental policies to economic strategies and foreign relations, the podcast paints a vivid picture of how each president’s approach has shaped the direction of the United States. This comparison is not just a study of differences but also a reflection on the evolving priorities of American governance. Through stimulating conversation and expert insights, these episodes explore the implications of each president’s agenda, offering listeners a nuanced perspective on the political landscape.

Impact on the Public: How Policies Affect Everyday Lives

Understanding the tangible impact of political decisions on everyday lives is a cornerstone of ‘What Am Politics?’ The podcast bridges the gap between high-level policy discussions and the real-world consequences for the public. Episodes focus on how the actions of the White House, the Supreme Court, and broader government policies influence healthcare, education, employment, and more. By talking about politics in relatable terms, the co-hosts make the connection between governmental decisions and daily life clear and compelling. This approach not only informs but also empowers listeners, highlighting the importance of informed citizenship and the role of individuals in a vibrant democracy.

Interviews and Discussions: Diverse Perspectives on Trump and Biden

‘What Am Politics?’ enriches its narrative by incorporating interviews and discussions with experts, activists, and thinkers, offering diverse perspectives on the administrations of Donald Trump and President Biden. These conversations extend beyond the co-hosts’ insights, bringing in fresh voices to the podcast. Episodes feature discussions on a wide range of topics, from the Supreme Court’s influence to the role of classified documents in national security. These interviews provide depth and breadth to the conversation, ensuring that listeners are not just hearing about politics but are engaging with it in a meaningful way.

Looking Forward: The Future of American Politics Post-Trump and Biden

As ‘What Am Politics?’ continues to explore the unfolding story of American politics, it also looks to the future, pondering the landscape post-Trump and Biden. The podcast examines the potential paths forward, discussing the challenges and opportunities that lie ahead for the United States. This forward-looking perspective is infused with a sense of hope and curiosity, encouraging listeners to think about what lies beyond the current political moment. By speculating on future episodes in the nation’s history, the podcast not only provides a space for interesting and fun discussion but also inspires a conversation about the kind of future we hope to create.